Payment option 1: VPOS

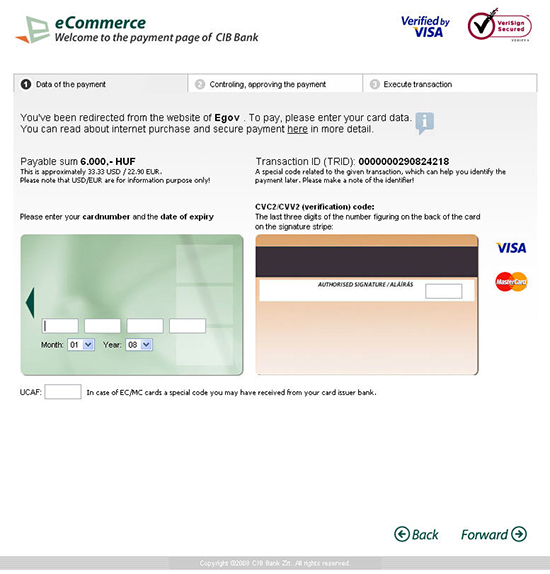

As a first step, you are redirected to the webpage of our partner bank, where you will encounter the following payment screen.

In the input fields on the bottom of the screen, you have to provide the data of your credit card, then, by clicking on the "Pay" button, the payment procedure can be initiated. By clicking on the "delete" button, the payment procedure may be interrupted.

Our company only receives the result of the transaction from the bank, bank card data are handled exclusively by the system of the bank. Data are encrypted during communication. The system of the bank uses the commonly used 128-bit SSL encoding, the server is certified by the certificate of VeriSign during the procedure.

Upon the completion of the payment procedure, you are returned to our webpage, where you will be informed of the success or failure of the payment transaction, as indicated on the screen below.

The system of our partner bank, and therefore our service, is prepared to accept transactions with credit cards belonging to the Europay and VISA product families. From among the credit cards authorized for buying, the following can be used to initiate transactions in the system:

- Eurocard/MasterCard

- VISA

- VISA Electron, with the exception that the possibility to use this type of card for internet-based transactions depends on the bank issuing the card. (It is determined by the issuing bank whether the usage of the card for internet-based, so-called "Cnp" or "Card not present" transactions is permitted or not.)

Download eCom CIB payment informant

(.doc format, 30 kb)

Questions and answers about card payments made on the internet

CARD ACCEPTANCE

What card types can be used for payment?

The embossed cards of VISA Eurocard/Mastercard and certain VISA Electron cards can be used for payment. Use on the internet of VISA Electron cards depends on the issuing bank. VISA Electron type cards issued by CIB can be used for buying on the internet.

Which bank cards are suitable for internet payment?

Any embossed VISA and Eurocard/MasterCard (EC/MC) card provided issuing bank permitted the use of the card for internet payment; as well as webcards specifically dedicated for being used on the internet are suitable.

Is it possible to pay with shopping cards?

It is not possible to pay on the internet with point-collecting loyalty cards issued by merchants/ service providers.

Is it possible to pay with co-branded cards?

It is possible to pay on the internet with any co-branded card provided its type is MasterCard or VISA and is suitable for internet payment.

THE PAYMENT PROCESS

How does the background process of online payment work in the bank?

After the buyer selected the method of bank card payment on the merchant’s or service provider’s website, as a result of having initiated the payment, the buyer gets to the Bank’s payment page which is equipped with a secure communication channel. The card number, the date of its expiry and the 3-digit validation code – this is located on the signature strip on the reverse side of the card – have to be entered to the payment. It will be you who starts the transaction, from that time on the card undergoes a real-time authorization process in which the genuineness of card data, the coverage and the purchase limit are verified. If all the data are satisfactory, the transaction can be continued and your account keeper (card issuer) bank blocks the payable amount on your card. The amount will be debited on your account (deducted) in a few days, depending on the account keeping bank.

What is the difference between buying on internet and a traditional purchase made using the card?

Difference is made between transactions made in the presence of the card (Card Present) and those made when the card is absent (Card not Present). The Card Present transaction takes place with the help of a POS terminal. After is card is swiped through and the PIN code is entered, the terminal contacts the cardholder’s bank via the authorization centre and, depending on the card type and the issuer, through the VISA or MasterCard network. This is where the validity and the coverage are verified (authorization). Retracing this path, the POS terminal (or the merchant) gets the authorization or rejection. The buyer signs the sales slip. Card not Present is a transaction when the bank card is not physically present at the purchase. Transactions made in letter, by phone or electronically (internet) belong here, where the buyer (cardholder) starts the transaction by entering card data requested on a payment page secured with 128-bit encryption. You will get a so-called authorization number about the successful transaction – this number agrees with the number on the paper-based sales slip.

What does reservation mean?

Reservation (blocking) follows as soon as the bank gets information about the transaction because the official data must be received to the actual debit entry which takes a few days and during this time it would be possible to spend again the money used on buying. This is why the money spent on buying or on cash withdrawal is separated, reserved. While the reserved amount is part of the account balance - but no interest is paid on it – it cannot be spent again. The reservation ensures the rejection of transactions for which the coverage is already lacking, even if the account balance would still theoretically permit it. If the debit entry fails to arrive within a few days, the bank may unlock the reserved amount so it can be spent.

UNSUCCESSFUL PAYMENTS AND WHAT TO DO THEN

Why a transaction may end in failure?

The usual cause is that the bank that issued the card (where the customer got the card) does not accept the payment order but, in case a bank card is used, it may be also caused by the circumstance that the request for authorization does not get to the bank that issued the card because of a telecommunication or computer error.

Error involving the card

- The card is not suitable for internet payment.

- The account keeping bank bans the use of the card on the internet.

- Card use is banned.

- Card data inputs were wrong (card number, expiry, code on the signature strip).

- The card expired.

Error involving the account

- There is no coverage to the execution of the transaction.

- The amount of the transaction exceeds the buying limit of the card.

Error involving the connection

- The line was probably interrupted during transaction. Please, try again.

- The transaction failed because the time was exceeded. Please, try again.

Technical error

- The transaction is unsuccessful if you fail to return from the payment page to the merchant’s or service provider’s page.

- If you come back from the payment page but the browser goes back to the payment page with the help of "back", "reload" or "refresh", the system will automatically reject your transaction for safety reasons.

What to do if the payment process is unsuccessful?

A transaction identifier is always generated about the transaction; we recommend to note it. Please contact your account keeping bank if the transaction is refused on the bank’s side in the course of the attempted payment.

Why do I have to contact my account keeping bank if the transaction is unsuccessful?

In the course of card verification the account keeper (card issuer) bank sends a note to the merchant’s (acquirer) bank asking if the transaction can be executed. The acquirer bank is not allowed to disclose confidential information to the customer of an another bank, only the bank that identifies the cardholder has the right to do so.

What does it mean if I get an SMS from my bank about the reservation/blocking of the amount but the merchant/service provider indicates that the payment was unsuccessful?

This can happen if the card was verified on the payment page but you did not return to the merchant’s/service provider’s internet website. In this case the transaction is deemed to be unfinished, thus unsuccessful. In such cases your card is not debited with the amount and the reservation is unlocked.

SECURITY

What is the meaning of VeriSign and SSL communication channel with 28- bit encryption?

SSL is the abbreviation of an accepted encryption process, Secure Sockets Layer. Our Bank has a 128-bit encryption key to protect the communication channel. A company called VeriSign permits CIB Bank Nyrt the use of the 128-bit key with which we ensure the SSL-based encryption. At the moment this encryption method is used in 90% of global e-commerce. Before transmission, the browser program used by the buyer encrypts the cardholder’s data with the help of SSL which means such data get to CIB Bank in coded form and are, as a consequence, incomprehensible for unauthorized third parties.

After the payment my browser warns me that I am about to leave the security zone. Is nevertheless the security of my payment guaranteed?

Yes, completely. The payment process takes place on a 128-bit encrypted communication channel so it is completely safe. After the transaction you get back to the merchant’s website. If the merchant’s website is not encrypted, your browser warns you that you have left the encrypted channel. This does not mean that the safety of the payment is jeopardized.

What is the meaning of the CVC2/CVV2 code?

In case of MasterCard the so-called Card Verification Code - in case of Visa the so-called Card Verification Value - is a numerical value stored on the magnetic strip of the card from which it can be established if the card exists. When you buy on the internet you have to specify the so-called CVC2 code, ie the last three numbers of the row of numbers located on the reverse side of Eurocard/MasterCard cards.

What does it mean Verified by Visa?

Holders of VISA cards who are registered in the Verified by Visa system select themselves a password at the bank that issued the card. They can identify themselves with the password in case of a purchase on the internet and the password also provides protection against the unauthorized use of Visa cards. CIB Bank accepts cards issued within the Verified by Visa system.

What is the meaning of the UCAF code?

A unique code you may have got from your card issuer bank in case of MasterCard cards. If you do not have this code, just leave the field blank.

magyar

magyar english

english